ETUOLIFE Kit de Fabrication de Bougies de Cire Bricolage,DIY Kit Bougie Inclus Cire Soja,Pot de Fabrication,Papier Magique,Mèches de Bougie-Kit pour Faire des Bougies Adulte Débutants à Avancés : Amazon.fr: Cuisine et Maison

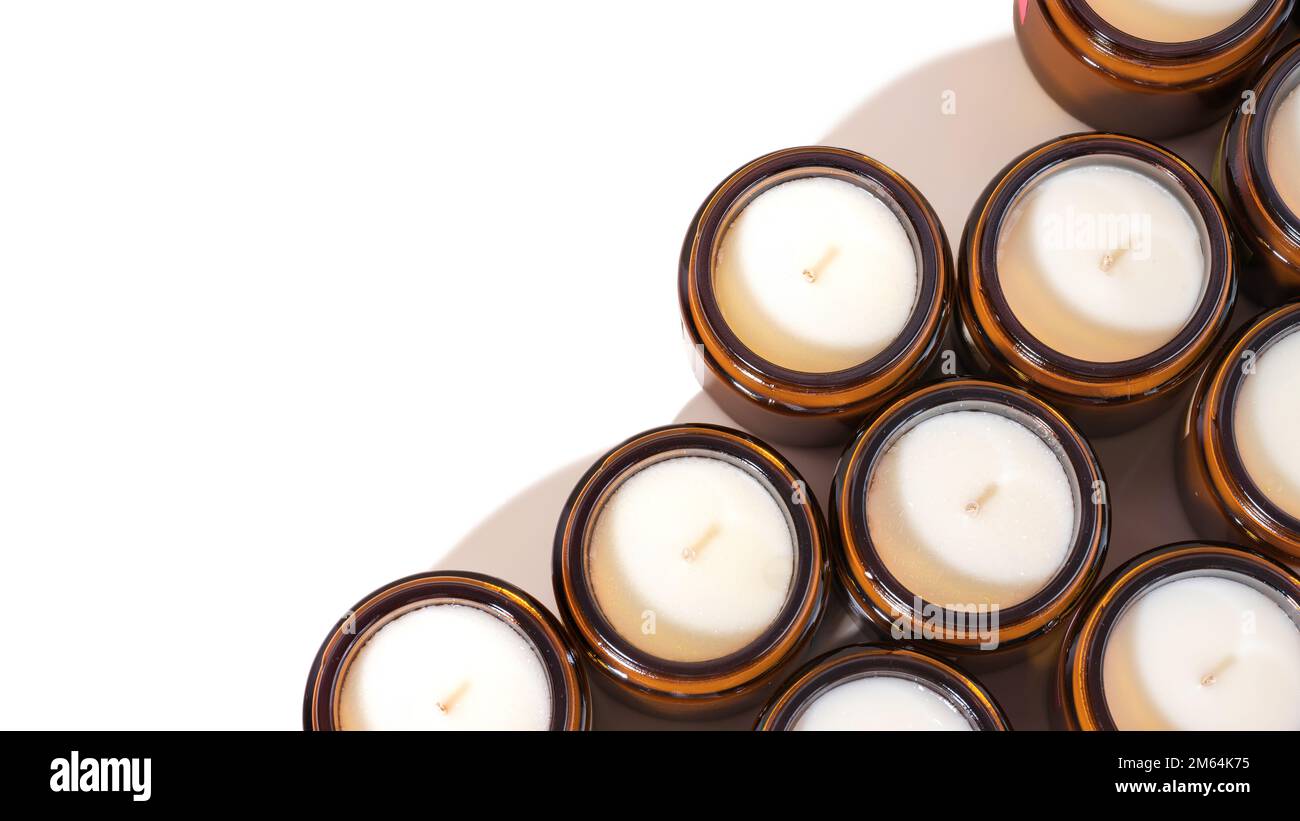

Un ensemble de différents arômes cire de soja bougies parfumées dans des pots en verre brun. Bougies naturelles essentielles dans un pot d'ambre. Concept tendy diy. Produit vegan sur un Photo Stock -

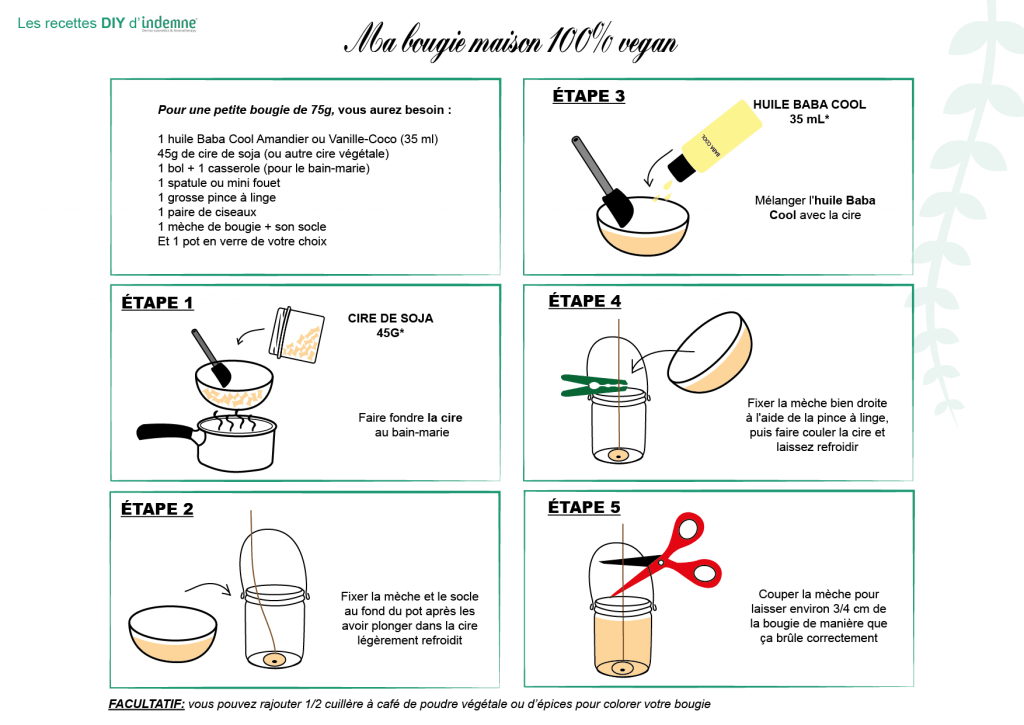

DIY : fabriquer une bougie à la cire végétale - L'heure de la sieste, sorties en famille, diy, anniversaire and more

DIY: BOUGIES NATURELLES A LA CIRE DE SOJA | La souris coquette Blog mode, maman, voyages, décoration, lifestyle

DIY: BOUGIES NATURELLES A LA CIRE DE SOJA | La souris coquette Blog mode, maman, voyages, décoration, lifestyle

:format(jpeg):quality(70)/https%3A%2F%2Fmedia.topito.com%2Fwp-content%2Fuploads%2F2021%2F06%2Fkit-fabrication-bougies-diy-cire-de-soja-vegetale-meches-bois-crepitante.jpg)